Why doesn't my markup % on my sales document match my gross profit % or the markup % I have set up on the part record?

When pricing is set to cost +%, you may expect the gross profit to match the markup percentage used, but there are actually two very different calculations used for this analysis.

For an easy example, let's say we have a part that costs $100 and the markup is 35% so we sell it for $135. That markup is 35%.

When we sell the part, our revenue is $135 and our cost is $100.

Gross profit on that sale is calculated by dividing your gross profit by your revenue. This is the universal calculation for GP percentages.

In this example, this would be 35 for your gross profit, divided by 135 for your revenue. This equals the 25.9% rather than the 35% you have set as the markup.

Furthermore, if your organization is using FIFO costing, the true cost of the part is not the cost used to calculate the margins, and therefore the markup % may vary.

FIFO costing means the part record cost is taking the newest parts cost available for the order. This is set up in parts setup under warehouses with the FIFO checkbox.

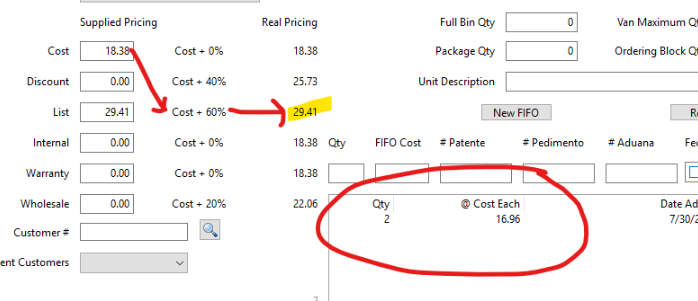

As an example, let's assume we have a hood spring. The part record is set up with cost of 18.38. The price calculation for that with a 60% markup would be 29.41 (18.38 X 1.6)

In the parts record, however, you can see in the FIFO receiving record that you last paid 16.96 for this part when you received them in; the list price is still calculated off the part calculated cost of 18.38.

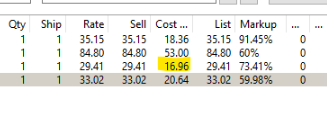

So, if you calculate the margin against the 16.96, you get the 73.41 markup that will be shown as the markup on the sales document, despite the markup being set to "cost + 60%" in the part record.

The markup is calculated as the sell price divided by the (true) cost of the part.

It will only come out to a markup of 60% when you last received the part at the exact same cost that is listed on the part record.

Related Articles

3.0 Lost Sales Report

Overview The Lost Sales Report is a tool used to track instances where a potential sale was not completed for various reasons. This report helps businesses understand why sales opportunities were missed and identify areas for improvement in their ...

How to set up core parts to post to a different account.

Our recommendation would be to set up a new parts group for your core part numbers in the parts setup tab under Groups. When setting up that parts group, you can then denote an inventory account for that group, which would be your Cores inventory ...

How do I back out a part I incorrectly received?

If the part has been incorrectly received, there is not a way to reverse the receiving. There is, however, a way to update the PO with a new record for a negative quantity. If the PO is closed, you will want to pull up the PO and choose the ...

3.0 How to stop a reocurring document

To stop a reoccurring document-- While the current work order is open, you would want to make sure that the reoccurring document checkbox on the additional info tab is not checked and also check that if there is a rental contract on the order that ...

How to set up a recurring rental contract to be invoiced every month.

Below are the steps to set up recurring rental documents in Softbase. To begin, open the invoicing tab and create a work order. Then, click on the rental info tab. Create a new rental contract or use an existing contract number and add it to the work ...